sitcity.ru Tools

Tools

Stock Market F

CNBC is the world leader in business news and real-time financial market coverage. Find fast, actionable information. Get the latest data from stocks futures of major world indexes. Find updated quotes on top stock market index futures. At Yahoo Finance, you get free stock quotes, up-to-date news, portfolio management resources, international market data, social interaction and mortgage. F-shares are five letter stock symbols ending in “F” that represent an equity traded on a foreign exchange. In some instances, the foreign ordinary shares. Key Data. Open $; Day Range - ; 52 Week Range - ; Market Cap $B; Shares Outstanding B; Public Float B; Beta Rather than trading stocks directly, a derivatives market trades in futures and options contracts and other advanced financial products that derive their value. Key Stats · Market CapB · Shares OutB · 10 Day Average VolumeM · Dividend · Dividend Yield% · Beta · YTD % Change The Securities and Exchange Commission (SEC) oversees securities exchanges, securities Main address. F Street, NE Washington, DC SHARE THIS PAGE. Ford Motor Co. ; Market Value, $B ; Shares Outstanding, B ; EPS (TTM), $ ; P/E Ratio (TTM), ; Dividend Yield, %. CNBC is the world leader in business news and real-time financial market coverage. Find fast, actionable information. Get the latest data from stocks futures of major world indexes. Find updated quotes on top stock market index futures. At Yahoo Finance, you get free stock quotes, up-to-date news, portfolio management resources, international market data, social interaction and mortgage. F-shares are five letter stock symbols ending in “F” that represent an equity traded on a foreign exchange. In some instances, the foreign ordinary shares. Key Data. Open $; Day Range - ; 52 Week Range - ; Market Cap $B; Shares Outstanding B; Public Float B; Beta Rather than trading stocks directly, a derivatives market trades in futures and options contracts and other advanced financial products that derive their value. Key Stats · Market CapB · Shares OutB · 10 Day Average VolumeM · Dividend · Dividend Yield% · Beta · YTD % Change The Securities and Exchange Commission (SEC) oversees securities exchanges, securities Main address. F Street, NE Washington, DC SHARE THIS PAGE. Ford Motor Co. ; Market Value, $B ; Shares Outstanding, B ; EPS (TTM), $ ; P/E Ratio (TTM), ; Dividend Yield, %.

Cboe is the first to offer a real-time view, market-wide, into Notional Value traded in the U.S. cash equity markets. Realtime Prices for Dow Jones Stocks ; Travelers, %. ; UnitedHealth, %. Breaking news and in-depth coverage from the global business and financial markets. The latest corporate earnings reports from the stock market and insights. stock if there is no price for more than consecutive trading days. This adjustment affects portfolios formed on book-to-market equity and. F-shares are five letter stock symbols ending in “F” that represent an equity traded on a foreign exchange. In some instances, the foreign ordinary shares. Find the latest Ford Motor Company (F) stock quote, history, news and other vital information to help you with your stock trading and investing. View data of the S&P , an index of the stocks of leading companies in the US economy, which provides a gauge of the U.S. equity market. World markets ; Dow. United States. 41, ; S&P United States. 5, ; NASDAQ. United States. 17, ; VIX. United States. ; Russell Ask. ; Ask Size. ; Exchange. NYSE. The Securities and Exchange Commission (SEC) oversees securities exchanges, securities Main address. F Street, NE Washington, DC SHARE THIS PAGE. Up-to-date stock market data coverage from CNN. Get the latest updates on US markets, world markets, stock quotes, crypto, commodities and currencies. Discover real-time Ford Motor Company Common Stock (F) stock prices, quotes, historical data, news, and Insights for informed trading and investment. NYSE: F · Price. $ · Volume. 20,, · Change. · % Change. % · Today's Open. $ · Previous Close. $ · Intraday High. $ · Intraday Low. CNBC is the world leader in business news and real-time financial market coverage. Find fast, actionable information. Get the latest stock market news, stock information & quotes, data analysis reports, as well as a general overview of the market landscape from Nasdaq. Google Finance provides real-time market quotes, international exchanges, up-to-date financial news, and analytics to help you make more informed trading. CFTC to Host a Career Forum for Law School Students. Registration opens for the September 25 event featuring Chair of the New York Stock Exchange Sharon Bowen. Cboe is the first to offer a real-time view, market-wide, into Notional Value traded in the U.S. cash equity markets. CFTC to Host a Career Forum for Law School Students. Registration opens for the September 25 event featuring Chair of the New York Stock Exchange Sharon Bowen. US STOCK MARKETS FUTURES ; DOW JONES Futures. 41, ; NASDAQ Futures. 19, ; S&P Futures. 5,

Roll Over Ira To Roth

_to_a_Roth_IRA_Account.png?width=657&name=Steps_in_Rolling_Over_a_Roth_401(k)_to_a_Roth_IRA_Account.png)

Key Takeaways · You can convert all or part of the money in a traditional IRA into a Roth IRA. · Even if your income exceeds the limits for making contributions. If you have an old (k), you should roll over your old (k) into a Rollover IRA immediately. You should open an IRA immediately if you don't have one. When should I roll over? You have 60 days from the date you receive an IRA or retirement plan distribution to roll it over to another plan or IRA. The IRS may. Rollovers must also be completed within 60 days of the distribution from the Traditional IRA. The five-year period for which Roth IRAs must be held before. It is considered a "rollover" if you are moving an IRA from one company to another. You have 60 days from the time you receive the funds from one company to. Use this form to convert all or a portion of an existing “traditional” Merrill Individual Retirement Account (IRA), Rollover IRA (IRRA®), SEP or SIMPLE. If you have money in a designated Roth (k), you can roll it directly into a Roth IRA without incurring any tax penalties. A rollover is a tax-free distribution to you from a previous retirement plan or IRA that you transfer to another retirement plan or IRA. A Roth IRA conversion involves moving assets from other retirement plans into your Roth IRA. Learn how to convert a Roth IRA and whether it's right for you. Key Takeaways · You can convert all or part of the money in a traditional IRA into a Roth IRA. · Even if your income exceeds the limits for making contributions. If you have an old (k), you should roll over your old (k) into a Rollover IRA immediately. You should open an IRA immediately if you don't have one. When should I roll over? You have 60 days from the date you receive an IRA or retirement plan distribution to roll it over to another plan or IRA. The IRS may. Rollovers must also be completed within 60 days of the distribution from the Traditional IRA. The five-year period for which Roth IRAs must be held before. It is considered a "rollover" if you are moving an IRA from one company to another. You have 60 days from the time you receive the funds from one company to. Use this form to convert all or a portion of an existing “traditional” Merrill Individual Retirement Account (IRA), Rollover IRA (IRRA®), SEP or SIMPLE. If you have money in a designated Roth (k), you can roll it directly into a Roth IRA without incurring any tax penalties. A rollover is a tax-free distribution to you from a previous retirement plan or IRA that you transfer to another retirement plan or IRA. A Roth IRA conversion involves moving assets from other retirement plans into your Roth IRA. Learn how to convert a Roth IRA and whether it's right for you.

Yes, it could make sense to open a Roth IRA at least five years before you plan to rollover your Roth (k). However, it's not enough to open it. Is a rollover from a regular IRA to a Roth IRA an allowable subtraction? If you decide to roll over your TSP assets to an IRA, you can choose either a traditional IRA or Roth IRA. No taxes are due if you roll over assets from a. Yes. The rollover must be to a Roth IRA account in the name of the plan beneficiary, not the account owner/participant. A rollover is when you move funds from one eligible retirement plan to another, such as from a (k) to a Traditional IRA or Roth IRA. Rollover distributions. No, there is no limit to the amount you can roll over to a Roth IRA. The standard annual contribution limits to a Roth IRA do not apply to a rollover. How do. Key Features · A rollover IRA is not a different IRA. It's a Traditional IRA or Roth IRA that you are using to consolidate your retirement accounts. · Most plans. Keep in mind that rolling money over from a traditional IRA to a Roth after 70½ won't reduce your RMD for the year of the conversion; the required withdrawal is. Transfer the assets by completing a mutual fund IRA Transfer Form or Brokerage IRA Transfer Form. Complete this IRA Roth Conversion Form. An IRA rollover1 is the process of transferring funds from an employer-sponsored retirement plan, often a (k) or (b), into an IRA retirement account. There is no limit to the number of conversions you can do, so you may convert smaller amounts over several years. Your time horizon. Generally, if you will need. Then locate the traditional IRA you want to convert and click Convert to Roth IRA. IS A ROTH IRA CONVERSION RIGHT FOR YOU? Understand the benefits of a Roth. Roth conversions are not subject to the IRS's 10% early withdrawal penalty, and there are no limits to the amount you choose to convert. The distribution from the IRA would have to be done by December 31 of the tax year. Then, if the distribution is completed on December 31, the transfer to the. Your Choices: · Roll over to a traditional IRA · Roll over to a Roth IRA · Take a lump-sum distributionFootnote · Leave the assets in your former plan · Move to a. A Roth IRA rollover is very simple to complete. Common practice is to simply contact the administrator for your current retirement account and request a. Since then, many people have converted all or a portion of their existing traditional IRAs to a Roth IRAs, where interest earned may be completely tax-free. Is. Trustee-to-trustee transfer: When your IRAs are at different financial institutions, you can tell the trustee of your traditional IRA to transfer an amount. You may also choose to consolidate all your traditional IRAs into one traditional IRA, or all your Roth IRAs into one Roth IRA, if eligible. This move can help. Remember, you should contact a tax professional to find out if a Roth IRA conversion rollover is right for you and how it works with your DCP After-tax Account.

What Can Be Itemized On Taxes

An individual may elect to claim itemized deductions of certain personal expenses in lieu of claiming a standard deduction in determining taxable income. A taxpayer may elect to itemize deductions on his or her federal return even if less than the standard deduction (for example, if the benefit of claiming. The standard deduction lowers your income by one fixed amount. On the other hand, itemized deductions are made up of a list of eligible expenses. Charitable contributions to an IRS-qualified (c)(3) public charity can only reduce your tax bill if you choose to itemize your taxes. Generally, you'd. What Are Itemized Deductions? An itemized deduction is basically any expense that can be subtracted from your (link: sitcity.ru Can I deduct my gambling losses? · What are Other Miscellaneous Deductions for Itemized Deductions? · Error · What if I don't know how much sales tax I paid during. An itemized deduction is an expense that can be subtracted from your adjusted gross income (AGI) to reduce your tax bill. Taxpayers can itemize deductions or. Miscellaneous deductions include expenses for items such as tax return preparation, safety deposit box rental, investment fees, gambling losses (you can only. However, the sum of qualified home mortgage interest and real estate property taxes may not exceed $20, For spouses filing as married filing separately or. An individual may elect to claim itemized deductions of certain personal expenses in lieu of claiming a standard deduction in determining taxable income. A taxpayer may elect to itemize deductions on his or her federal return even if less than the standard deduction (for example, if the benefit of claiming. The standard deduction lowers your income by one fixed amount. On the other hand, itemized deductions are made up of a list of eligible expenses. Charitable contributions to an IRS-qualified (c)(3) public charity can only reduce your tax bill if you choose to itemize your taxes. Generally, you'd. What Are Itemized Deductions? An itemized deduction is basically any expense that can be subtracted from your (link: sitcity.ru Can I deduct my gambling losses? · What are Other Miscellaneous Deductions for Itemized Deductions? · Error · What if I don't know how much sales tax I paid during. An itemized deduction is an expense that can be subtracted from your adjusted gross income (AGI) to reduce your tax bill. Taxpayers can itemize deductions or. Miscellaneous deductions include expenses for items such as tax return preparation, safety deposit box rental, investment fees, gambling losses (you can only. However, the sum of qualified home mortgage interest and real estate property taxes may not exceed $20, For spouses filing as married filing separately or.

Individual taxpayers may choose to either itemize their individual nonbusiness deductions or claim a standard deduction. If your Kansas itemized deductions are. Itemize Deductions · 1. Unreimbursed Medical and Dental Expenses · 2. Long-term Care Insurance Premiums · 3. Taxes You Paid · 4. Interest You Paid · 5. Charity. While few taxpayers choose to do so, the IRS allows you to pick from a menu of individual deductions that can ultimately add up to a lower tax bill than if you. The deduction is available to taxpayers that itemize deductions, not those who take the standard deduction. The deduction is based on adjusted gross income and. In contrast, the itemized deduction is a dollar-for-dollar deduction that differs from taxpayer to taxpayer. The itemized deduction amount is determined by. Itemized deductions include specific expenses such as medical bills, mortgage interest, charitable donations, and state/local taxes. These can be more. Standard Deduction and Itemized Deduction. As with federal income tax returns, the state of Arizona offers various credits to taxpayers. An individual may. And here's the big kicker: You can only start deducting medical expenses once they've surpassed % of your adjusted gross income (AGI). You can't include. When you itemize deductions, including tax breaks for homeowners, you forgo the standard deduction. Instead, the total amount of the itemized deductions will. Itemized deductions are an alternative to the standard tax deduction and can help you reduce your total federal income tax bill. Deductions are amounts that. 31 of the taxable year, you may deduct the entire amount contributed during the taxable year. Only the owner of record for an account may claim a deduction for. By itemizing your deductions, you first give up the standard deduction. In its place, you list out your expenses in approved categories – interest and medical. Itemized deductions are tax breaks you can only take if you itemize. In effect, by itemizing, you're foregoing the standard deduction (you can't get both). Federal · 3 percent of income in excess of an income threshold; or · 80 percent of total itemized deductions, excluding deductions for medical expenses. Generally, if the taxpayer's itemized deduction exceeds the standard deduction, the taxpayer should apply the itemized deduction since this would result in a. Under United States tax law, itemized deductions are eligible expenses that individual taxpayers can claim on federal income tax returns and which decrease. This is where itemized medical deductions can come in. The federal government allows taxpayers to write a portion of these medical expenses off of their tax. Mortgage interest · State and local taxes, including income taxes and property taxes · Eligible medical costs exceeding 10% of your adjusted gross income (AGI). If you itemize, you can deduct a part of your medical and dental expenses, amounts you paid for certain taxes, inter- est, gifts to charity, and certain. Itemized deductions include expenses that are not otherwise deductible, including mortgage interest you paid on up to two homes, state and local income or sales.

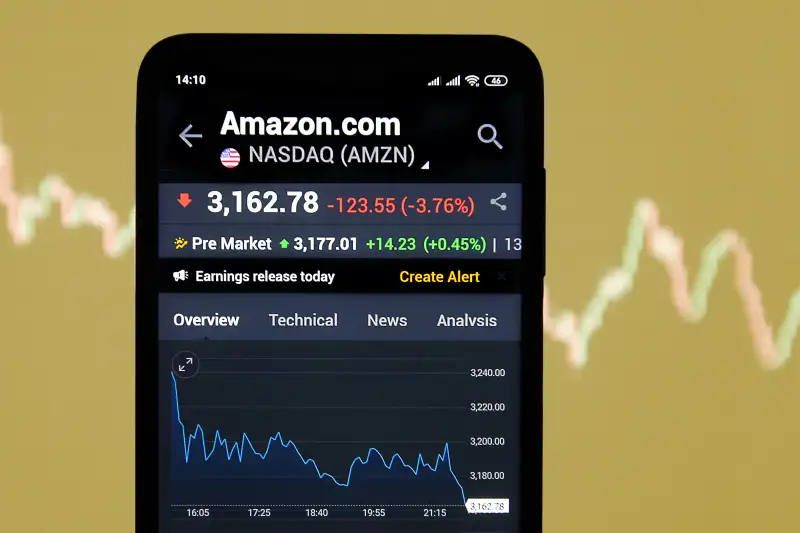

Can I Buy Amazon Stock Directly

Make sure your products are safe and compliant. Customers trust that they can always buy with confidence in the Amazon store. Products offered for sale in the. Best Stocks to Buy: Amazon Stock vs. Apple Stock. 4 hours ago • The They do not store directly personal information, but are based on uniquely. Learn how to buy Amazon shares with no commission at Axi. Discover the latest on AMZN shares including market cap, stock price, and trading hours. Access Direct is an online, self-directed brokerage account which means you can do things like buy or sell mutual funds, ETFs, or other stock and help you. The Fund Sentiment Score (fka Ownership Accumulation Score) finds the stocks that are being most bought by funds. It is the result of a sophisticated, multi. How can I purchase sitcity.ru Inc. shares in India? · Directly: By opening an international trading account with Angel One. The process would include KYC. If you're comfortable buying shares directly with one of the many US share investing platforms, it has never been easier for New Zealanders to own Amazon shares. Amazon finds support from accumulated volume at $ and this level may hold a buying opportunity as an upwards reaction can be expected when the support is. When you buy stock in a company in the market, rather than directly from the company, the benefit or the company is trivial an indirect. Your. Make sure your products are safe and compliant. Customers trust that they can always buy with confidence in the Amazon store. Products offered for sale in the. Best Stocks to Buy: Amazon Stock vs. Apple Stock. 4 hours ago • The They do not store directly personal information, but are based on uniquely. Learn how to buy Amazon shares with no commission at Axi. Discover the latest on AMZN shares including market cap, stock price, and trading hours. Access Direct is an online, self-directed brokerage account which means you can do things like buy or sell mutual funds, ETFs, or other stock and help you. The Fund Sentiment Score (fka Ownership Accumulation Score) finds the stocks that are being most bought by funds. It is the result of a sophisticated, multi. How can I purchase sitcity.ru Inc. shares in India? · Directly: By opening an international trading account with Angel One. The process would include KYC. If you're comfortable buying shares directly with one of the many US share investing platforms, it has never been easier for New Zealanders to own Amazon shares. Amazon finds support from accumulated volume at $ and this level may hold a buying opportunity as an upwards reaction can be expected when the support is. When you buy stock in a company in the market, rather than directly from the company, the benefit or the company is trivial an indirect. Your.

Are stocks a long-term investment? Or do you want to try to make quick money in the short-term out of the stock market fluctuations? How much. AMZN does not currently pay a dividend. Shares. Market Capitalization (Large The information does not usually directly identify you, but it can give you a. Rather than receiving these shares all at once, shares vest over time. For many Amazon employees, these RSUs can make up a large portion of their total. However, there are some potential risks and headwinds that could impact Amazon's stock price, such as increased regulatory scrutiny. You can buy Amazon shares outright through IG's share dealing service. When you own Amazon stock, you would hope for two types of returns: gains in the share. Robinhood's default buy order is an order to buy a number of shares or dollar amount of the specified stock or ETP. During regular market hours ( AM Additionally, investing in U.S stocks can offer exposure to global markets Receive information of your transactions directly from Stock Exchange. Best Stocks to Buy: Amazon Stock vs. Apple Stock. 4 hours ago • The They do not store directly personal information, but are based on uniquely. Investing in the Funds is not equivalent to investing directly in AMZN. AMZU ETFs are generally available for purchase on exchanges, much like stocks—and can. How can I purchase sitcity.ru Inc. shares in India? · Directly: By opening an international trading account with Angel One. The process would include KYC. Despite Amazon's massive size, its massive growth in recent years, and its massive employee base, Amazon does not offer an Employee Stock Purchase Plan (ESPP). Now you can own fractional shares of any of America's leading companies in the S&P ® for as little as $5, even if their shares cost more. · Buy a single slice. Just like with any Amazon purchase you make, if you are unsatisfied with the product for any reason, you can return the item in accordance with Amazon's Returns. Additionally, investing in U.S stocks can offer exposure to global markets Receive information of your transactions directly from Stock Exchange. How to trade Amazon shares If you want to invest in Amazon, you can buy and own the physical share, for example through a stockbroker, at a price you think. However, there are some potential risks and headwinds that could impact Amazon's stock price, such as increased regulatory scrutiny. Identity Requirements for Non-U.S. Citizens · Opening a Brokerage Account · Tax Implications of U.S. Investments Abroad · Estate Tax for Non-US Stock Holders · What. Our network includes hundreds of fulfillment centers worldwide and can help you reach customers around the globe. buy. Visit Seller Central Help to. If a seller can't deliver your item, they'll refund you quickly so that you can place a new order. We require sellers to keep these stock issues to a minimum. If you don't want to sell your shares, you can hold onto them in your stock plan account. directly to the plan by your company or its service providers.

Short Interest High

/https://blogs-images.forbes.com/danielfisher/files/2014/09/ronco-SI-1.jpg)

Regardless, most options traders would agree that if a short-interest ratio is defined as the number of days to cover, more than 10 days is pretty high. The short interest ratio represents the number of days it takes short sellers on average to cover their positions, that is repurchase all of the borrowed. If a stock has a high short interest, short positions may be forced to liquidate and cover their position by purchasing the stock. If a short squeeze occurs. This can increase the daily volatility of the stock. A high percentage of short interest usually means that many investors think the stock price is going to go. When the short interest ratio is high, the number of shares that will be repurchased in the open market after short selling is high. Similarly, if the short. When the short interest of a company increases, it is often a warning sign that the stock sentiment is bearish (negative) and that investors expect the stock. Key Points. A stock that rallies hyperbolically when there are no obvious current events driving the response, could be experiencing a short squeeze. Generally speaking, a high volume of short interest indicates that investors have a negative outlook for the company (although heavy short interest can also. Definitions vary, but a short interest as a percentage of float above 20% is extremely high. Also, a “days to cover” above 10 indicates extreme pessimism. Regardless, most options traders would agree that if a short-interest ratio is defined as the number of days to cover, more than 10 days is pretty high. The short interest ratio represents the number of days it takes short sellers on average to cover their positions, that is repurchase all of the borrowed. If a stock has a high short interest, short positions may be forced to liquidate and cover their position by purchasing the stock. If a short squeeze occurs. This can increase the daily volatility of the stock. A high percentage of short interest usually means that many investors think the stock price is going to go. When the short interest ratio is high, the number of shares that will be repurchased in the open market after short selling is high. Similarly, if the short. When the short interest of a company increases, it is often a warning sign that the stock sentiment is bearish (negative) and that investors expect the stock. Key Points. A stock that rallies hyperbolically when there are no obvious current events driving the response, could be experiencing a short squeeze. Generally speaking, a high volume of short interest indicates that investors have a negative outlook for the company (although heavy short interest can also. Definitions vary, but a short interest as a percentage of float above 20% is extremely high. Also, a “days to cover” above 10 indicates extreme pessimism.

The higher the short-interest ratio, the more likely a short squeeze is to occur, as competition to rebuy shares spikes. Best Online Brokers for Trading Short. A significant increase in short interest between reporting periods is an indication that more investors believe a company's stock price will go down in the. The total amount of outstanding shorted shares is "short interest." Traders usually engage in short selling, which involves selling security by borrowing. The abnormal returns on. NYSE-Amex stocks with high short interest are more negative and more well- behaved across portfolios than for Nasdaq stocks. Desai et. Stocks with Highest Short Interest · 30 Symbols · 3 Stock-Split Stocks Soared 2,% to 4,% in the Last 5 Years (Hint: Nvidia Ranks Third). Short interest is often expressed as a percentage or ratio (the number of shares sold short divided by the total number of shares outstanding). High short. The Short Sale Trading Statistics Summary Report prepared by IIROC shows the aggregate proportion of short selling in the total trading activity of a. Stocks with high short interest ; Medical Properties Trust, MPW, ; Kohl's, KSS, ; Sunnova Energy, NOVA, ; Cassava Sciences, SAVA, Koyfin gives the inside skinny on short interest stocks with high potential in volatile markets. Visualize & analyze short interest charts. Data shows these stocks typically have higher short interest, but that also stays consistently in a range of around %. Short interest ratios are very stable. Many investors believe that rising short interest positions in a stock is a bearish indicator. They use the Days to Cover statistic as a way to judge rising. “Short interest” is a snapshot of the total open short positions existing on the books and records of brokerage firms for all equity securities on a given. Many investors believe that rising short interest positions in a stock is a bearish indicator. They use the Days to Cover statistic as a way to judge rising. The total amount of outstanding shorted shares is "short interest." Traders usually engage in short selling, which involves selling security by borrowing. Nasdaq short interest is available by issue for a rolling 12 months and updated twice a month. Short Interest data is based on a mid-month and end of month. The scoring model uses a combination of short interest, float, short borrow fee rates, and other metrics. The number ranges from 0 to , with higher numbers. An increase or decrease in short interest indicates whether investors are optimistic or pessimistic about a company's future. When it comes to a company's. No. You should buy stocks that are going up at high time frames, that have corrected some in lower time frames, and are renewing their. In the past, academic research has shown that stocks with high levels of short interest are connected with a high probability of experiencing negative. To help increase market transparency, Cboe makes available, without charge, a summary of consolidated market short interest positions in all Cboe-listed.

Is Paypal Credit Good For Building Credit

PayPal Credit is a reusable, digital credit line with no annual fee The front of the PayPal Cashback Mastercard. Experian Boost is an easy way for you to take control of your credit and build long-term credit health—just by paying your bills. I've used PayPal credit for about 10 years, not often and not as a primary source but I've had zero issues with it. Ever. You're better off. Not only do customers enjoy the flexibility of PayPal Credit, 96% of first-time PayPal Credit shoppers want to use it again in the future. In fact, 94% of. The Chime Credit Builder Visa card is good for those who want to build credit but don't want to be bound by minimum deposits. Annual Fee, None. Security deposit. The PayPal Cashback Mastercard is a good credit card for people with fair credit or better who regularly make purchases through PayPal and want to earn. An approved PayPal Credit application will result in a hard credit inquiry, which may impact your credit score. 2. PayPal Purchase Protection is available on. New credit can help improve your credit scores. Having new positive tradelines reporting on your credit report shows lenders that you are able to be trusted to. Find out how PayPal credit works, how you can apply, where it is accepted & how you can easily set up payments on time to avoid any late payment fees. PayPal Credit is a reusable, digital credit line with no annual fee The front of the PayPal Cashback Mastercard. Experian Boost is an easy way for you to take control of your credit and build long-term credit health—just by paying your bills. I've used PayPal credit for about 10 years, not often and not as a primary source but I've had zero issues with it. Ever. You're better off. Not only do customers enjoy the flexibility of PayPal Credit, 96% of first-time PayPal Credit shoppers want to use it again in the future. In fact, 94% of. The Chime Credit Builder Visa card is good for those who want to build credit but don't want to be bound by minimum deposits. Annual Fee, None. Security deposit. The PayPal Cashback Mastercard is a good credit card for people with fair credit or better who regularly make purchases through PayPal and want to earn. An approved PayPal Credit application will result in a hard credit inquiry, which may impact your credit score. 2. PayPal Purchase Protection is available on. New credit can help improve your credit scores. Having new positive tradelines reporting on your credit report shows lenders that you are able to be trusted to. Find out how PayPal credit works, how you can apply, where it is accepted & how you can easily set up payments on time to avoid any late payment fees.

PayPal, including sitcity.ru Get more with PayPal Credit. Dollar icon. More payment flexibility. Buy now. Pay over time. You decide what's best for you. Map. PayPal's Pay Monthly loan impacts credit score as it's reported to credit Was this article helpful? Yes No. Related topics. What is Pay Monthly? Does. PayPal Credit is essentially cardless credit that offers shoppers extra time to pay off their purchases. It's a credit limit that's attached to your PayPal. PayPal Credit is a line of credit available to approved PayPal users. This credit is issued by Synchrony Bank and it works similar to a traditional credit card. PayPal does not normally report to credit agencies, but the banks that handle such credit agreements often do. Instead of a traditional APR, LoanBuilder by PayPal charges a flat borrowing fee, ranging from % to % of the loan amount. So, for example, if you. PayPal PayPal Credit reviews () · I never have a problem with PayPal. · I'm always happy to use to PayPal. · Customer Services was very helpful · There when. paypal credit allow merchants to sell and incraese conversion of organization. It easy easy to use for customer and very feasible. Use PayPal Credit's digital, reusable credit line to shop online anywhere PayPal is accepted, and get 6 months special financing on purchases of $99+ every. For example, if your credit line is $, you have a $ balance, and you attempt to make a purchase or request a cash advance of $, PayPal may view this as. Yes, responsible use of PayPal Credit can help you build credit. PayPal Credit reports to credit bureaus, so timely payments and responsible use can increase. PayPal Credit can assist in establishing credit with responsible use. Payments on time, low credit utilisation, and positive credit history can enhance a credit. “Every purchase you make with a POS loan is considered a separate account on your credit report that gets closed once you pay off the balance. Since these loans. There's also no credit check to apply! Credit Builder is a secured credit card. The money you move into Credit Builder's secured account is the amount you can. How do I know if Discover is the best secured credit card for me? PayPal Credit can assist in establishing credit with responsible use. Payments on time, low credit utilisation, and positive credit history can enhance a credit. Unlike credit cards, Pay in 4 isn't reported to credit bureaus, so your on-time payments won't build your score. Soft credit check: When you. The PayPal credit card is concise in its offering, making it a great fit for consumers looking for a simple way to save money on their purchases. However, there. for facilitating a Send Money transaction. We have the right to decline cash advance transactions for any reason permitted by applicable law, including if. Compare credit cards from our partners, view offers and apply online for the card that is the best fit for you. Advertiser Disclosure: Many of the card offers.

Dow Jones 30 Companies

The Dow 30 or US 30 is a stock index comprised of 30 large, publicly traded American companies whose stock prices collectively act as a barometer of the. Dow Jones Index (DJIA): List of 30 Companies ; Boeing, NYSE: BA ; Caterpillar, NYSE: CAT ; Chevron, NYSE: CVX ; Cisco Systems, NASDAQ: CSCO ; Coca-Cola, NYSE: KO. The Dow Jones Industrial Average (DJIA), Dow Jones, or simply the Dow is a stock market index of 30 prominent companies listed on stock exchanges in the. Track the latest stock market news happening on the Dow Jones today. Plus, get timely analysis of the DJIA and 30 Dow stocks. Thirty years later USR merged with. Continental AG of Germany to form. Uniroyal. A giant tire that the com- pany created for the World's. Fair in New. Citigroup Corp. Travelers Inc (Travelers Companies), Maintained Sell. $, schlecht. 7/30/, Morgan Stanley Today, the Dow Jones Industrial Average. A Complete Dow Jones Industrial Average overview by Barron's. View stock market news, stock market data and trading information. Dow Jones 30 Constituents ; Coca-Cola Co, KO ; Dow Inc, DOW ; Exxon Mobil Corp. XOM ; Goldman Sachs Group, Inc. GS. The 30 stocks which make up the Dow Jones Industrial Average are: 3M, American Express, Amgen, Apple, Boeing, Caterpillar, Chevron, Cisco Systems, Coca-Cola. The Dow 30 or US 30 is a stock index comprised of 30 large, publicly traded American companies whose stock prices collectively act as a barometer of the. Dow Jones Index (DJIA): List of 30 Companies ; Boeing, NYSE: BA ; Caterpillar, NYSE: CAT ; Chevron, NYSE: CVX ; Cisco Systems, NASDAQ: CSCO ; Coca-Cola, NYSE: KO. The Dow Jones Industrial Average (DJIA), Dow Jones, or simply the Dow is a stock market index of 30 prominent companies listed on stock exchanges in the. Track the latest stock market news happening on the Dow Jones today. Plus, get timely analysis of the DJIA and 30 Dow stocks. Thirty years later USR merged with. Continental AG of Germany to form. Uniroyal. A giant tire that the com- pany created for the World's. Fair in New. Citigroup Corp. Travelers Inc (Travelers Companies), Maintained Sell. $, schlecht. 7/30/, Morgan Stanley Today, the Dow Jones Industrial Average. A Complete Dow Jones Industrial Average overview by Barron's. View stock market news, stock market data and trading information. Dow Jones 30 Constituents ; Coca-Cola Co, KO ; Dow Inc, DOW ; Exxon Mobil Corp. XOM ; Goldman Sachs Group, Inc. GS. The 30 stocks which make up the Dow Jones Industrial Average are: 3M, American Express, Amgen, Apple, Boeing, Caterpillar, Chevron, Cisco Systems, Coca-Cola.

Stocks: Most Actives · Stocks: Gainers · Stocks: Losers · Trending Tickers · Futures Dow Jones Industrial Average (^DJI). Follow. 41, + (+ Companies in the Dow Jones Industrial Average · 3M (MMM %) · Amazon (AMZN %) · American Express (AXP %) · Amgen (AMGN %) · Apple (AAPL %). Current DJIA Stocks ; Coca-Cola Company. Travelers Companies, Inc. ; DowDuPont. UnitedHealth Group ; Exxon Mobil Corporation. United Technologies Corporation. The Dow Jones Industrial Average (also known as the DJIA, Dow Jones, Dow 30 or the Dow) is a US stock market index that tracks the performance of 30 large. The thirty companies included in the Dow Jones Industrial Average are listed below. The list is sorted by each component's weight in the index. The Dow Jones Industrial Average, Dow Jones, or simply the Dow, is a stock market index of 30 prominent companies listed on stock exchanges in the United. The most commonly quoted is the Dow Jones Industrial Average (DJIA), which is based on the prices of 30 industrial stocks. Other Dow Jones averages include. A · Amazon (company) · American Express · Amgen · Apple Inc. B. Boeing. C. Caterpillar Inc. The Global X Dow 30 Covered Call ETF (DJIA) follows a “covered call” or “buy-write” strategy, in which the Fund buys the stocks in the Dow Jones Industrial. Dow 30 Dividend Stocks, ETFs, Funds ; Apple sitcity.ru AAPL ; Microsoft CorporationMicrosoft. MSFT ; JPMorgan Chase & CoJPMorgan Chase. JPM ; Walmart sitcity.rut. List of the largest companies included in the Dow Jones index by market capitalization. The market capitalization sometimes referred as Marketcap. DOW JONES STOCKS ; Amazon, , ; American Express, , ; Amgen, , ; Apple, Both underlie a number of investment products, are published by S&P Dow Jones Indices, and track the stocks of large U.S. companies. Stock Selection. Review. Dow Jones Industrial Average ; AAPL:US. ; AMGN:US. ; AMZN:US. ; AXP:US. ; BA:US. Wall Street's top Dow Jones stocks to buy include Apple, sitcity.ru and some other names that might surprise you. Largest dow jones companies by market cap ; favorite icon, 3. Amazon logo. Amazon. 3AMZN ; favorite icon, 4. JPMorgan Chase logo. JPMorgan Chase. 4JPM ; favorite. The Dow Jones Industrial Average provides a view of the US stock market and economy. Originally, the index was made up of 12 stocks, it now contains The Dow 30, or Dow Jones Industrial Average, is a stock index that tracks the performance of the 30 biggest companies listed on the stock indices in the United. Dow Jones Industrial Average DJIA. search. View All companies. PM EDT 08/29/ ; %. 1 Day Range - 52 Week Range. The Dow Jones Industrial Average® (The Dow®), is a price-weighted measure of 30 U.S. blue-chip companies. The index covers all industries except.

Homeowners Insurance Cover Septic

Yes, Alfa home insurance does cover septic tanks. It provides coverage for septic tanks as part of its standard home insurance policy. Standard homeowners insurance covers several types of water damage, most of which are considered sudden and accidental. Is Septic Back-up Covered by Homeowners Insurance? Your homeowners insurance policy does not cover the system itself. It does cover your home however, if. If your septic tank leaks and causes damage to your property, the good news is that this is going to be covered under your policy. In short, homeowners insurance typically covers sudden and accidental damage from plumbing issues, but it may not cover the cost of repairing or replacing the. For example, plumbing issues could be covered if a pipe bursts unexpectedly and causes water damage to your home. However, homeowners insurance does not cover. Insurance Coverage for Damaged or Destroyed Septic Systems · 1) All components of the septic system are covered under the “Dwelling” category. · 2) One can't work. Does a Home Warranty Cover a Septic System? Liberty Home Guard offers coverage for septic systems as well as kitchen appliances, air conditioning units, and. Does homeowners insurance cover your sewer line if it's damaged? Damage to your sewer line may be covered by your policy if it is caused by perils such as hail. Yes, Alfa home insurance does cover septic tanks. It provides coverage for septic tanks as part of its standard home insurance policy. Standard homeowners insurance covers several types of water damage, most of which are considered sudden and accidental. Is Septic Back-up Covered by Homeowners Insurance? Your homeowners insurance policy does not cover the system itself. It does cover your home however, if. If your septic tank leaks and causes damage to your property, the good news is that this is going to be covered under your policy. In short, homeowners insurance typically covers sudden and accidental damage from plumbing issues, but it may not cover the cost of repairing or replacing the. For example, plumbing issues could be covered if a pipe bursts unexpectedly and causes water damage to your home. However, homeowners insurance does not cover. Insurance Coverage for Damaged or Destroyed Septic Systems · 1) All components of the septic system are covered under the “Dwelling” category. · 2) One can't work. Does a Home Warranty Cover a Septic System? Liberty Home Guard offers coverage for septic systems as well as kitchen appliances, air conditioning units, and. Does homeowners insurance cover your sewer line if it's damaged? Damage to your sewer line may be covered by your policy if it is caused by perils such as hail.

Homeowners insurance typically covers losses resulting from a sudden malfunction, such as a pipe bursting unexpectedly. However, a homeowners policy won't. Most homeowners insurance policies will not cover the source of the water damage. So, while your policy may cover the cost of tearing out and replacing that. If you have overflows or backups from your sump pump, sewer system or drains, your standard policy will not cover the damage. Coverage may be available, however. This protection covers various types of pipe material, regardless of how old it is. Sewer Septic Line Image 2. What Do Exterior Sewer Septic Line Repair Plans. Well, they aren't excluded. However, a homeowners policy isn't a maintenance policy either. So pumping out a septic tank or moving it due to. Water damage from a burst pipe is typically covered under a standard HO3 homeowner's insurance policy. However, damage caused by sewer and drain backups is not. Basic homeowners insurance coverages · Ordinance or law insurance. May help pay to rebuild your home to current building codes after a covered loss. · Other. For the most part, standard homeowners insurance covers water damage that is caused by a broken pipe or water leaking through the ceiling. It doesn't cover. Grange home insurance coverages · Dwelling coverage. Covers damage to your home's physical structure. · Personal property coverage. · Personal liability coverage. Most homeowners insurance policies will not cover the source of the water damage. So, while your policy may cover the cost of tearing out and replacing that. Therefore, damage resulting from neglect, lack of routine maintenance, or failure to address known issues is not usually covered. Normal Wear and Tear- Septic. No, a homeowners insurance policy does not automatically include sewer backup coverage. However, many home insurance companies offer it as an optional coverage. Most of the home insurance policies specify that they will cover any vandalism to septic tanks: if it is due to human error and lack of proper maintenance. If your septic tank has been damaged, the cost might be covered under the “other structures” portion of your homeowners' insurance policy. Basic home insurance also generally doesn't cover water damage caused by sewer backup and sump pumps — unless you add an optional coverage, known as Water. A typical homeowners insurance policy (also known as an HO3 policy) generally covers your home and your personal property and helps cover the costs of losses. Most home insurance companies offer a sewer backup endorsement. This typically carries a coverage limit between $5, and $25, to cover your personal. A home warranty protects your budget when your septic pump needs to be repaired or replaced due to normal wear and tear. This covers damage caused by water or sewage that backs up through the plumbing from outside the home. Does homeowners insurance cover roof damage from trees? Most insurance policies will cover you for accidental damage to a septic tank and other underground services. We can manage the whole claims process for.

Best Stocks To Buy On Dip Today

How about a best month to buy stocks, or to sell them? In this article, we best day to sell stock—before prices dip. If you're interested in short. Stocks to BUY on the DIP ; 1. Hindustan Zinc, , , ; 2. Adani Total Gas, , , The buy-the-dip stock list is composed of stocks with strong earnings performance over the last five years. These are companies that are growing and are. The strategy is also ideal for trading certain types of markets prone to high-value dips over time. Some stocks that offer valuable dip opportunities include. 2 Top Dividend Stocks to Buy On the Dip · 1. Realty Income · 2. Home Depot. Hi, · Auto stock will be best stock to buy in dip, since most of the auto expect few stock like TATA Motors is performing good, with average CAGR. now at $95 or even lower. That's the dip The answer to the “when” is the “where.” In other words, asking “Where's the best place to plot a purchase? Why Nvidia's Post-Earnings Dip Is Actually Good News for Stocks. By Luke Lango, InvestorPlace Senior Investment Analyst Aug 29, Typically, a post-earnings. now at $95 or even lower. That's the dip The answer to the “when” is the “where.” In other words, asking “Where's the best place to plot a purchase? How about a best month to buy stocks, or to sell them? In this article, we best day to sell stock—before prices dip. If you're interested in short. Stocks to BUY on the DIP ; 1. Hindustan Zinc, , , ; 2. Adani Total Gas, , , The buy-the-dip stock list is composed of stocks with strong earnings performance over the last five years. These are companies that are growing and are. The strategy is also ideal for trading certain types of markets prone to high-value dips over time. Some stocks that offer valuable dip opportunities include. 2 Top Dividend Stocks to Buy On the Dip · 1. Realty Income · 2. Home Depot. Hi, · Auto stock will be best stock to buy in dip, since most of the auto expect few stock like TATA Motors is performing good, with average CAGR. now at $95 or even lower. That's the dip The answer to the “when” is the “where.” In other words, asking “Where's the best place to plot a purchase? Why Nvidia's Post-Earnings Dip Is Actually Good News for Stocks. By Luke Lango, InvestorPlace Senior Investment Analyst Aug 29, Typically, a post-earnings. now at $95 or even lower. That's the dip The answer to the “when” is the “where.” In other words, asking “Where's the best place to plot a purchase?

The problem with active funds is you never know whether a dip is a buying opportunity or a sign to sell. Best diversification for stocks is non-stocks . I buy schd and VOO daily for 20 dollars each and save the rest of the money I have for dips, whether that be individual stocks or schd and VOO. How about a best month to buy stocks, or to sell them? In this article, we best day to sell stock—before prices dip. If you're interested in short. The S&P (SNPINDEX: ^GSPC) climbed 14% through June, its fifth-best first half in the last quarter century. Four stocks -- Nvidia, Microsoft, Alphabet. best companies to buy at dip ; 2. P & G Hygiene, ; 3. Bajaj Holdings, ; 4. Bharat Electron, ; 5. Divi's Lab. The wisdom (or folly) of buying the dip may be best seen in hindsight. For example, let's say you were scared off from buying stocks by the – Stocks to BUY on the DIP ; 1. Hindustan Zinc, , , ; 2. Adani Total Gas, , , INVESTING ADVICE ; Top Performers · Allbirds Inc - Ordinary Shares Class A (BIRD) · Bakkt Holdings Inc - Ordinary Shares - Class A (BKKT) ; Earnings Stalwarts. now at $95 or even lower. That's the dip The answer to the “when” is the “where.” In other words, asking “Where's the best place to plot a purchase? The S&P (SNPINDEX: ^GSPC) climbed 14% through June, its fifth-best first half in the last quarter century. Four stocks -- Nvidia, Microsoft, Alphabet. The S&P (SNPINDEX: ^GSPC) climbed 14% through June, its fifth-best first half in the last quarter century. Four stocks -- Nvidia, Microsoft, Alphabet. World EV Day: 6 Best budget electric cars you can buy under Rs 20 lakh in India · Stock Radar: Down 20% from highs, Tata Technologies takes support above. CVU, rising more than 1% on Monday for a third straight gain, is trading at the top of the cup's left lip. For now, CPI Aerostructures is actionable. But. The buy-the-dip stock list is composed of stocks with strong earnings performance over the last five years. These are companies that are growing and are. What is the best stock buying strategy for buying "the dip"? Should you buy stocks on the dip today? 18, Views · Will the stock. Buy on Dips ; Nesco Ltd. , 6 ; GHCL. , 6 ; JTEKT India. , 6 ; West Coast Paper. , 8. 2 Top Dividend Stocks to Buy On the Dip · 1. Realty Income · 2. Home Depot. The Five Best Buy The Dip Stocks include: [5] Asana [4] SoFi [3] Affirm [2] Upstart and [1] Celsius Holdings. best companies to buy at dip ; 1. Bosch, ; 2. P & G Hygiene, ; 3. Bajaj Holdings, ; 4. Bharat Electron,

Managing A Family Trust

Trust administration is the management of the assets that exist within a trust. A trust is created when an individual (known as a settlor) places their. A trust can help you protect and secure your family's wealth, not just for yourself and your children, but also for future generations. How trust accounts work. Setting up a trust: 5 steps for grantor · Decide what assets to place in your trust. · Identify who will be the beneficiary/beneficiaries of your trust. A living trust can help you manage your assets or protect you should you become ill, disabled or simply challenged by the symptoms of aging. Most living trusts. The trust deed will state who has the power to appoint and remove trustees. The settlor – or anyone else who is named in the trust deed – can have this power. The flexibility of trusts is another key component to there being an effective estate management solution. There are different kinds of trust, each catering to. An irrevocable living trust is usually set up to reduce estate or income taxes. For tax purposes, the trust becomes a separate entity; the assets cannot be. trust might be a good estate planning option for you and your family. 3 managing money. A trust is a plan to take care of the people you love when. How is a living trust funded? A living trust becomes valid only after the creator executes the necessary documents and then “funds” the trust by transferring. Trust administration is the management of the assets that exist within a trust. A trust is created when an individual (known as a settlor) places their. A trust can help you protect and secure your family's wealth, not just for yourself and your children, but also for future generations. How trust accounts work. Setting up a trust: 5 steps for grantor · Decide what assets to place in your trust. · Identify who will be the beneficiary/beneficiaries of your trust. A living trust can help you manage your assets or protect you should you become ill, disabled or simply challenged by the symptoms of aging. Most living trusts. The trust deed will state who has the power to appoint and remove trustees. The settlor – or anyone else who is named in the trust deed – can have this power. The flexibility of trusts is another key component to there being an effective estate management solution. There are different kinds of trust, each catering to. An irrevocable living trust is usually set up to reduce estate or income taxes. For tax purposes, the trust becomes a separate entity; the assets cannot be. trust might be a good estate planning option for you and your family. 3 managing money. A trust is a plan to take care of the people you love when. How is a living trust funded? A living trust becomes valid only after the creator executes the necessary documents and then “funds” the trust by transferring.

The responsibilities of a trustee include management of the assets that are identified within a trust. A lot of estate holders elect to act as their own trustee. Family trusts require ongoing maintenance. A family trust requires ongoing accounting and tax advice throughout its life. These costs start at $1,, plus GST. The grantor assigns a trustee to carry out the asset management guidelines outlined in the family trust. These guidelines can include how an asset can be used . A living trust is a legal document that, just like a will, contains your instructions for what you want to happen to your assets when you die. But, unlike a. Sometimes referred to as revocable living trusts; Created by the grantor Strategically managing and investing trust assets; Filing trust tax returns. The Basics of Trust Administration · Gather essential documents. · Provide notice to · Identify and value assets · Identify debts · Responsibly invest trust assets. A family trust is more commonly known as a living trust. This is a legal document that retains ownership of titled property and financial assets. That said, a trust arrangement can offer greater control of property management and decisions regarding the use of the property. It can define roles and. The law requires you to manage the money and property in the trust for Rose's benefit, not yours. It does not matter if you are managing a lot of money or a. Trustees are compensated for their work unless the fees are waived, as sometimes occurs with family member trustees. The management of trust assets includes. The purpose of a family trust is to protect and manage family wealth, ensuring its smooth transfer and preservation across generations. By placing assets into a. Protecting and preserving your assets. · Customizing and controlling how your wealth is distributed. · Minimizing federal or state taxes. · Addressing family. A Living Trust is a legal tool for financial planning that allows a person (Trustee) to hold another person's (Settlor's) property for the benefit of someone. Family Trusts in Canada for Estate Planning and Wealth Management · 1) Reduce taxes your family will pay upon the death of a trust beneficiary. · 2) Manage. The trustee can be a bank, a trust company, another professional, or one or more family members (spouse, son, daughter, or self). Usually the trustee is someone. Choosing a Trustee is important because that person may be managing your property for a long time. You can name a family member, a friend, a professional. Living Trusts and Testamentary Trusts: Living trusts become effective during the grantor's lifetime; testamentary trusts become effective after the grantor's. Families have been using trusts for wealth management and wealth protection for the benefit of their heirs for centuries. Trusts provide people with a. A trustee is a person or persons holding legal title to trust property. The trustee's primary role is to manage the trust assets to benefit the persons named as. Family trusts are legal devices. As with any trust fund, family trusts transfer management or ownership of assets to a third party. A family trust is used to.