sitcity.ru Learn

Learn

8 Lbs Of Fat

Have a great week guys! Cheers. I Tried to Lose 10 lbs of Body Fat in 50 Days and Overachieved! M views · 8 months ago more. Goal Guys. Keep in mind that one pound of fat equals about 3, calories, per Harvard Health Publishing. This means you must create a 3,calorie deficit — whether. Plan to lose one pound a week if you eat less calories each day and burn calories each day for a total of 3, calories in a week. Maintain your diet. This chart shows you how many pounds you can hope to lose per week based on how many calories you cut out of your daily diet. What can you eat? Each. Reducing your carb intake causes your body to burn stored fat for energy, leading to weight loss. Dinner: 6 oz baked chicken breast, 1 cup (8 oz) broccoli, 1. Table Body fat percentages for males and females and their classification. Males. Females. Rating. Athletic. Good. It's best to aim for losing 1 to 2 pounds per week. This is more likely to be a sustainable loss, especially if you achieve it by eating a balanced diet and. So, to lose 5 pounds, you would need to burn 17, additional calories. How Many Calories Are in a Pound of Body Fat? There are 3, calories in a pound of. What this myth does not account for is the body's response to the changes in body composition and diet (Trusted Source 8). When you reduce calorie intake. Have a great week guys! Cheers. I Tried to Lose 10 lbs of Body Fat in 50 Days and Overachieved! M views · 8 months ago more. Goal Guys. Keep in mind that one pound of fat equals about 3, calories, per Harvard Health Publishing. This means you must create a 3,calorie deficit — whether. Plan to lose one pound a week if you eat less calories each day and burn calories each day for a total of 3, calories in a week. Maintain your diet. This chart shows you how many pounds you can hope to lose per week based on how many calories you cut out of your daily diet. What can you eat? Each. Reducing your carb intake causes your body to burn stored fat for energy, leading to weight loss. Dinner: 6 oz baked chicken breast, 1 cup (8 oz) broccoli, 1. Table Body fat percentages for males and females and their classification. Males. Females. Rating. Athletic. Good. It's best to aim for losing 1 to 2 pounds per week. This is more likely to be a sustainable loss, especially if you achieve it by eating a balanced diet and. So, to lose 5 pounds, you would need to burn 17, additional calories. How Many Calories Are in a Pound of Body Fat? There are 3, calories in a pound of. What this myth does not account for is the body's response to the changes in body composition and diet (Trusted Source 8). When you reduce calorie intake.

Convert pounds to calories (lbs to kcal) with the weight conversion calculator, and learn the pound to calorie formula. Height and Weight Chart ; 5' 5", to lbs. to lbs. ; 5' 6", to lbs. to lbs. ; 5' 7", to lbs. to lbs. ; 5' 8", to. Other Units. Age, ages 8 - Gender, male female. Height. feet, inches. Weight, pounds. Height, cm. Weight, kg. Activity Level. Little or no exercise. One pound of mostly-fat body weight is the equivalent of 3, calories of either food or exercise. · The appropriate amount of calories to cut from your diet is. Compare your weight loss journey visually with this educational visualization of 8lbs (kg) of fat. Certified personal trainer and exercise. However, BMI does not distinguish between fat mass and fat free mass 8. Fontes-Carvalho R et al. Am J Cardiol. ; (11): 9. Yu H. Height and Weight Chart ; 5' 5", to lbs. to lbs. ; 5' 6", to lbs. to lbs. ; 5' 7", to lbs. to lbs. ; 5' 8", to. You're in the dreaded "last 10 pounds" zone (though in reality it may be more like 12, or 8, or 5). fat [rather than lean muscle mass] because the body. 8 lbs is 28, calories. So if you eat a day and have a resting metabolism that means that if you run 5 miles a day ( calories) that would mean. Burn more calories than you take in each day and you'll lose weight. The rule used to be that to lose 1 pound (lb) of fat, you needed to burn 3, more. 6 common reasons why it is hard to lose last few pounds · Our bodies evolved to send hunger and eating signals to build up and retain fat. · As you've cut back on. The Diet: Fast on 2 out of every 7 days. On fasting days eat – calories. The 16/8 method: Fast for 16 hours and eat only during an 8-hour window. Fat, protein and other nutrients = 6 to 8 pounds; Placenta = pounds. The placenta grows in your uterus and supplies the baby with food and oxygen through. However, BMI does not distinguish between fat mass and fat free mass 8. Fontes-Carvalho R et al. Am J Cardiol. ; (11): 9. Yu H. Average weight loss on orlistat is about 8 to 11 percent of initial Body weight, body fat, energy metabolism, and fat oxidation are regulated by. Buy Great Value % Pure Beef Burgers, 75% Lean/25% Fat, 8 lbs, 32 Count (Frozen) at sitcity.ru Finished with a 1-mile time! Went from 2 to 4 Pull-Ups. Lost 8lbs Body Fat. Where you put on pounds matters, too. People who have visceral fat (belly fat) – even if they're not technically overweight – are more likely to develop gout. In the past, research found about 3, calories of energy equaled about 1 pound ( kilogram) of fat. 8 of a inch restaurant pizza), , Regular. Body Fat Percentage · Visceral Fat · Bone Mass · Total Body Water (Hydration) 7. KGs Total, Pounds (lbs), Stone, Pounds. , , 14, 8. , , 14, 9.

Long Term Equity

A TRADITIONAL, LONG-ONLY, 'BUY AND HOLD' FUND THAT SEEKS TO IDENTIFY COMPANIES FROM AROUND THE WORLD WITH THE POTENTIAL FOR LONG-TERM CAPITAL APPRECIATION. SBI Long Term Equity Fund - Regular Plan - Growth, 5, , , , , , JM ELSS Tax Saver Fund - Growth, 5, , , , An equity investment is money that is invested in a company by purchasing shares of that company in the stock market. The scheme aims to generate regular long term capital growth from a diversified portfolio of equity and equity related securities. The investment objective of the Scheme is to seek to generate long-term capital growth from an actively managed portfolio primarily of Equity and Equity. SBI Long Term Equity Fund Direct Plan Growth - Get latest NAV, SIP Returns & Rankings, Ratings, Fund Performance, Portfolio, Expense Ratio, Holding Analysis. To invest in high‐quality, sustainable businesses run by long‐term orientated management teams. · To apply the investment process in a manner intended to move. LEAPS (Long-Term Equity Anticipation Security) are options for terms that are longer than those of the most common options on equities and indices. We believe that the changes could enable insurers to invest in Long Term Equity while enhancing their solvency ratios and potentially improving the expected. A TRADITIONAL, LONG-ONLY, 'BUY AND HOLD' FUND THAT SEEKS TO IDENTIFY COMPANIES FROM AROUND THE WORLD WITH THE POTENTIAL FOR LONG-TERM CAPITAL APPRECIATION. SBI Long Term Equity Fund - Regular Plan - Growth, 5, , , , , , JM ELSS Tax Saver Fund - Growth, 5, , , , An equity investment is money that is invested in a company by purchasing shares of that company in the stock market. The scheme aims to generate regular long term capital growth from a diversified portfolio of equity and equity related securities. The investment objective of the Scheme is to seek to generate long-term capital growth from an actively managed portfolio primarily of Equity and Equity. SBI Long Term Equity Fund Direct Plan Growth - Get latest NAV, SIP Returns & Rankings, Ratings, Fund Performance, Portfolio, Expense Ratio, Holding Analysis. To invest in high‐quality, sustainable businesses run by long‐term orientated management teams. · To apply the investment process in a manner intended to move. LEAPS (Long-Term Equity Anticipation Security) are options for terms that are longer than those of the most common options on equities and indices. We believe that the changes could enable insurers to invest in Long Term Equity while enhancing their solvency ratios and potentially improving the expected.

Short-term equity investments are considered as risky, whereas long-term investments are considered much more profitable and consistent in terms of returns. Our. Long-term Equity strategy is purpose built to find them and drive them forward. Generation's leadership in sustainable investing gives us the ability to. The fund has an expense ratio of %, which is close to what most other Elss funds charge. SBI Long Term Equity Fund Direct Plan-Growth returns of last 1-year. LEAPS clearly explains the concepts behind the creation of long term equity anticipation securities as well as basic strategies, from bullish to bearish to. Key Points. LEAPS allow long-term options trading with expiration over a year away. Investors can use LEAPS for lower cost stock position via call options. long-term organic growth. However, as private equity firms have shown, the strategy is ideally suited when, in order to realize a onetime, short- to medium. Click here to know more about SBI Long Term Equity Fund. An investor education initiative. Investors should deal only with registered Mutual Funds, details. Concentrated portfolio of primarily US equity securities selected for their long-term growth outlook, including fundamentals, franchise strength, and. The US MBD: Long-Term Incentive and Equity Report allows you to benchmark your LTI rewards strategy against more than 3, organizations from 14 different. This paper analyzes the two main changes affecting the insurance capital treatment of equity investments: amended criteria for the. Long-Term Equity Investment. Long-short equity is an investment strategy that seeks to take a long position in underpriced stocks while selling short overpriced shares. Long-short seeks to. The BlackRock Long-Term U.S. Equity ETF seeks to achieve long-term capital growth. LEAPS clearly explains the concepts behind the creation of long term equity anticipation securities as well as basic strategies, from bullish to bearish to. Being a diversified equity fund, it has the potential for long-term wealth creation. The 3-year lock-in helps you stay invested and creates investment. Investment Details. Long-Term Equity Fund (LTF) are a family of equity funds (which invest heavily in listed companies in the Stock Exchange of Thailand) that. BNY Mellon Long Term Global Equity Fund*. A TRADITIONAL, LONG-ONLY, 'BUY AND HOLD' FUND THAT SEEKS TO IDENTIFY COMPANIES FROM AROUND THE WORLD WITH THE. Equity fund - A mutual fund/collective fund in which the money is Treasury bond - Negotiable long-term (10 years or longer) debt obligations. Long Term Equity Fund (LTF) * Investment involves risks. Investors should carefully study the product features, terms and conditions, performance and risk. Read more about IH Long-Term Equity Advisors Interogo Holding is a foundation-owned investment group. Our investment strategies include private and long-term. The Funds invest in equity instruments of companies with strong fundamentals and high potential returns. Investment in LTF is not tax-deductible from January 1.

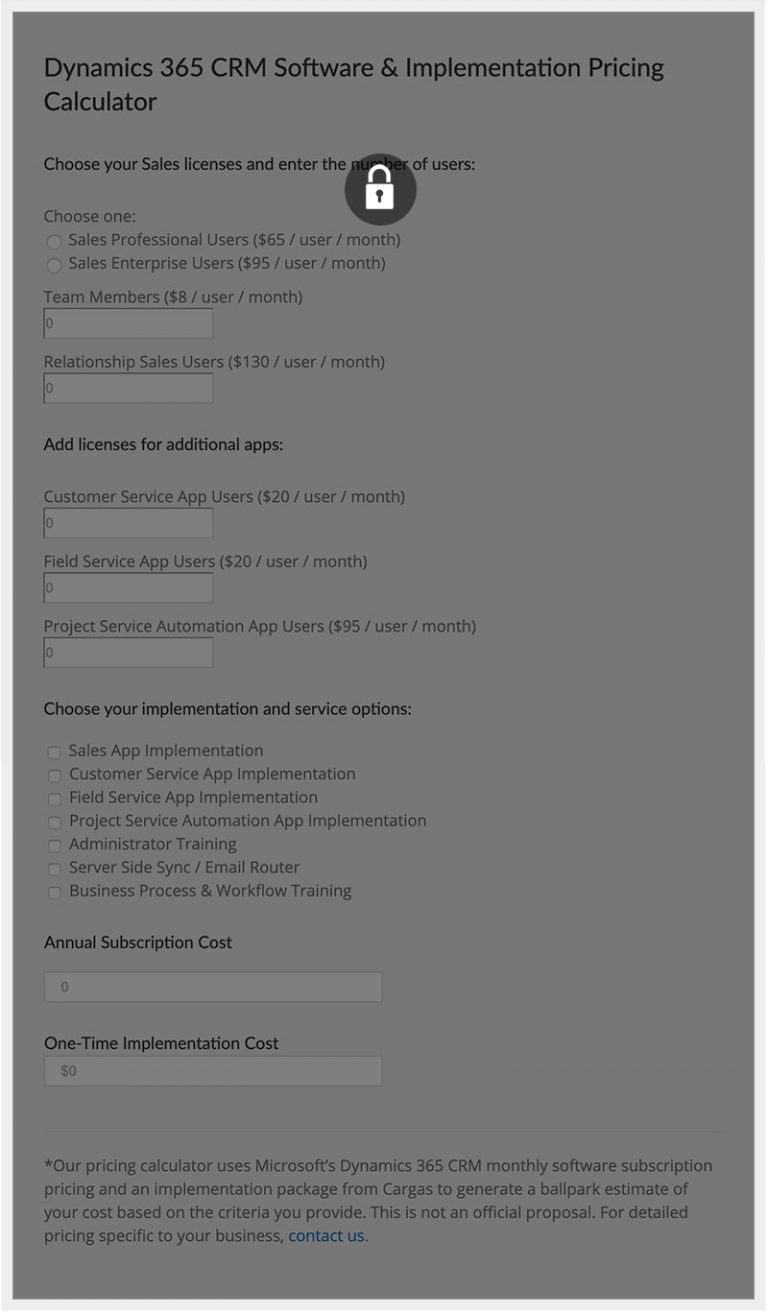

Crm Calculator

Use our CRM Calculator to optimize customer relationship management strategies and improve your business efficiency. Try it now for better results. Understand the definition of statistical significance and learn how to calculate it using Freshmarketer's FREE A/B testing calculator. Our CRM calculator lets you easily customize a fixed price package that meets your needs. Select the options you need below. To use the CRM Roi Calculator Identify your current sales scenario In the greyed out cells in the BLUE section of the “ROI” worksheet, enter your current sales. Find out how much you can save with Insightly using a CRM Cost Calculator. Input data about your current CRM and discover the savings. How to use the CRM Calculator Template The CRM Calculator is an interactive experience that assists users on finding their ROI as well as other detailed. Find out how much you can save with Insightly using a CRM Cost Calculator. Input data about your current CRM and discover the savings. Showcase customized plans and products · Covert more traffic into leads · Offer personalized options to prospects · Automatically sync new contacts to HubSpot CRM. Our CRM Return on Investment (ROI) Calculator is designed to help businesses visualise the tangible benefits of implementing a CRM system. By providing insights. Use our CRM Calculator to optimize customer relationship management strategies and improve your business efficiency. Try it now for better results. Understand the definition of statistical significance and learn how to calculate it using Freshmarketer's FREE A/B testing calculator. Our CRM calculator lets you easily customize a fixed price package that meets your needs. Select the options you need below. To use the CRM Roi Calculator Identify your current sales scenario In the greyed out cells in the BLUE section of the “ROI” worksheet, enter your current sales. Find out how much you can save with Insightly using a CRM Cost Calculator. Input data about your current CRM and discover the savings. How to use the CRM Calculator Template The CRM Calculator is an interactive experience that assists users on finding their ROI as well as other detailed. Find out how much you can save with Insightly using a CRM Cost Calculator. Input data about your current CRM and discover the savings. Showcase customized plans and products · Covert more traffic into leads · Offer personalized options to prospects · Automatically sync new contacts to HubSpot CRM. Our CRM Return on Investment (ROI) Calculator is designed to help businesses visualise the tangible benefits of implementing a CRM system. By providing insights.

CRM · Overview of all products. Marketing Hub. Marketing automation software Calculate your other costs with our TCO Calculator. $. Update cost. More Resources Like This. Explore similar resources. Whitepaper. The State of CRM Report. Calculate your ROI for investing in the HubSpot Marketing hub. Fill in your details, download your ROI report and see how you can improve your business. Zoho CRM offers comprehensive bundle solutions comprising of sales, marketing, and service apps. Use this calculator to check the price of your own custom. The CRM ROI Calculator is designed to help businesses assess the Return on Investment (ROI) of their Customer Relationship Management (CRM) system. It considers. Calculate your own CRM pricing plan. From £28/$43 per month. Get a full CRM quotation, fast. First, choose your package and how many licenses you need. We develop custom CRM applications for all devices. Rubyroid Labs provides CRM development services for leaders. Contact us! Get a free project cost estimate from ScienceSoft, a CRM development company with 15 years of experience. This simple ROI calculator will ask you for some basic information about your business, and in return, it will show you how you can boost your productivity and. Showcase customized plans and products · Covert more traffic into leads · Offer personalized options to prospects · Automatically sync new contacts to HubSpot CRM. Find out just how much your business could benefit from Salesforce and CRM with this new benefit calculator built specifically for small and medium. It is calculated as a percentage of revenue increase or savings to show how your bottom line is positively impacted by the CRM software. Résolu: Hi All I need to create a pricing calculator for our reps the price is based on 4 properties and not that complex. I see multiple solutions. This Return on Investment Calculator (“ROI Calculator”) is provided by. By using the ROI Calculator and clicking the “Calculate” button, you agree that the. The basic formula for calculating CRM's ROI is simple and clear: CRM ROI = (Gains from CRM investment – Cost of CRM investment) / Cost of CRM investment. More Resources Like This. Explore similar resources. Whitepaper. The State of CRM Report. Accessing the Calculator. To open the calculator, select Utilities > Financial Calculator from the side menu. Note: Enterprise customers who do not see the. ResponseCRM Calculator. Customers Per Day Sign-up Amount $ Shipping/Order $ COGS $ Sign-up Refund % Media Cost/Order Sign-up Chargeback $ Processing Fees %. Get the fair value for Salesforce (CRM). Using our DCF model we can see the intrinsic value of CRM. Easy to use, fully customizable. % free, no signups. Résolu: Hi All I need to create a pricing calculator for our reps the price is based on 4 properties and not that complex. I see multiple solutions.

How Do You Invest In Etfs

This robust tool lets you evaluate ETFs or mutual funds side-by-side, streamlining the selection process and helping you make better-informed investment. This brochure explains the basics of mutual fund and ETF investing, how each investment option works, the potential costs associated with each option, and how. Exchange traded funds (ETFs) combine diversification, low costs, and real-time market pricing. Learn about your ETF investing options at Vanguard. At JP Morgan, we're combining the built-in benefits of ETFs with our best-in-class research insights, portfolio expertise and trading capabilities. An exchange-traded fund (ETF) is a type of investment fund that is also an exchange-traded product, i.e., it is traded on stock exchanges. Diversify your investment portfolio quickly, easily and conveniently. Buy and sell funds on an exchange in real time and get liquidity when you need it. When you invest in an ETF, you get a bundle of assets you can buy and sell during market hours—potentially lowering your risk and exposure, while helping to. Exchange traded funds (ETFs) are a low-cost way to earn a return similar to an index or a commodity. They can also help to diversify your investments. Our robust lineup of active and passive exchange-traded funds, research tools, and expertise can help make it easier to find the right ETFs for you. This robust tool lets you evaluate ETFs or mutual funds side-by-side, streamlining the selection process and helping you make better-informed investment. This brochure explains the basics of mutual fund and ETF investing, how each investment option works, the potential costs associated with each option, and how. Exchange traded funds (ETFs) combine diversification, low costs, and real-time market pricing. Learn about your ETF investing options at Vanguard. At JP Morgan, we're combining the built-in benefits of ETFs with our best-in-class research insights, portfolio expertise and trading capabilities. An exchange-traded fund (ETF) is a type of investment fund that is also an exchange-traded product, i.e., it is traded on stock exchanges. Diversify your investment portfolio quickly, easily and conveniently. Buy and sell funds on an exchange in real time and get liquidity when you need it. When you invest in an ETF, you get a bundle of assets you can buy and sell during market hours—potentially lowering your risk and exposure, while helping to. Exchange traded funds (ETFs) are a low-cost way to earn a return similar to an index or a commodity. They can also help to diversify your investments. Our robust lineup of active and passive exchange-traded funds, research tools, and expertise can help make it easier to find the right ETFs for you.

An exchange-traded fund (ETF) is a collection of investments such as equities or bonds. ETFs will let you invest in a large number of securities at once. Exchange traded funds (ETFs) are a low-cost way to earn a return similar to an index or a commodity. They can also help to diversify your investments. In this article, we'll explore the ins and outs of investing in ETFs and guide you through the process of getting started. Investors have multiple options for buying iShares ETFs: Fidelity Investments, At Fidelity, you can start with as little as $1 when you buy fractional shares. You need a brokerage account to invest in ETFs (exchange-traded funds). If you have any questions along the way, we're happy to help. ETFs by investing goals No matter what you're looking to achieve financially, our ETFs can help you invest with confidence. Consider accessing the world's. ETFs (exchange-traded funds) are a great way to add diversification to your portfolio. E*TRADE lets you trade every ETF sold, plus over commission-free. Part of the appeal of ETFs is their liquidity, which provides the flexibility to turn an investment into ready cash quickly, with no loss in value. In most. This Investor Bulletin discusses only ETFs that are registered as open-end investment companies or unit investment trusts under the Investment Company. Choose your own. At Schwab, we make it easy to start investing in ETFs, DIY-style, with straightforward research, and powerful, easy-to-use tools. ETFs offer built-in diversification and don't require large amounts of capital in order to invest in a range of stocks, they are a good way to get started. An exchange-traded fund (ETF) is a collection of investments such as equities or bonds. ETFs will let you invest in a large number of securities at once. Instead of diversifying your portfolio with individual stocks, you can cover entire sectors with ETF. Get the best possible price execution on your ETF. ETFs offer investors access to a wide range of markets around the world usually at low cost. Most ETFs are passive investments, meaning they simply aim to track. ETFs are offered on virtually every conceivable asset class from traditional investments to so-called alternative assets like commodities or currencies. In. An Exchange-Traded Fund (ETF) is like a basket of different investments, such as stocks, bonds, or commodities, that you can buy or sell on the. Many new investors start out investing with mutual funds and exchange-traded funds (ETFs) since they require smaller investment amounts to create a diversified. ETFs trade on exchange, which is why many investors use them. Like stocks, an ETF can be traded anytime during the trading hours of the exchange that the ETF is. Exchange-traded-funds, or ETFs, are similar to mutual funds in that they invest in a basket of securities, such as stocks, bonds, or other asset classes.

Costco Fee

Costco Raises Membership Fee for First Time in 7 Years. What It Means for the Stock. Costco is raising its membership fee for the first time since —and. Upgrade to Executive Membership online - anytime, anywhere! Upgrade and you'll enjoy: icon Annual 2% Reward* icon Exclusive offers and additional discounts. Shop sitcity.ru for electronics, computers, furniture, outdoor living, appliances, jewelry and more. Enjoy low warehouse prices on name-brands products. Unlimited 3% on restaurants and eligible travel, including Costco Travel. + No annual fee with your active/paid Costco membership. 2%. Please consider our self-service options such as Price Adjustment, Return/Replace Order, Membership Renewal, In-Home Delivery and Installation Service FAQs or. You may remit your renewal fee by mail, online at sitcity.ru, or at any warehouse. Costco members may charge their membership fees automatically on any Visa ®. The basic membership fee will go up $5 to $65 a year and Costco's Executive Membership will be increased by $10 to $ annually. Costco membership. Shop sitcity.ru for electronics, computers, furniture, outdoor living, appliances, jewelry and more. Enjoy low warehouse prices on name-brands products. The Executive Membership upgrade fee is an additional $65 a year for Business or Gold Star Members (plus sales tax where applicable). We will prorate the. Costco Raises Membership Fee for First Time in 7 Years. What It Means for the Stock. Costco is raising its membership fee for the first time since —and. Upgrade to Executive Membership online - anytime, anywhere! Upgrade and you'll enjoy: icon Annual 2% Reward* icon Exclusive offers and additional discounts. Shop sitcity.ru for electronics, computers, furniture, outdoor living, appliances, jewelry and more. Enjoy low warehouse prices on name-brands products. Unlimited 3% on restaurants and eligible travel, including Costco Travel. + No annual fee with your active/paid Costco membership. 2%. Please consider our self-service options such as Price Adjustment, Return/Replace Order, Membership Renewal, In-Home Delivery and Installation Service FAQs or. You may remit your renewal fee by mail, online at sitcity.ru, or at any warehouse. Costco members may charge their membership fees automatically on any Visa ®. The basic membership fee will go up $5 to $65 a year and Costco's Executive Membership will be increased by $10 to $ annually. Costco membership. Shop sitcity.ru for electronics, computers, furniture, outdoor living, appliances, jewelry and more. Enjoy low warehouse prices on name-brands products. The Executive Membership upgrade fee is an additional $65 a year for Business or Gold Star Members (plus sales tax where applicable). We will prorate the.

Costco hikes membership fee for the first time since Costco is hiking annual membership fees in the U.S. and Canada by $5, and raising. One-Year Costco Membership with a $20 or $40 Digital Costco Shop Card. All vehicles arranged for sale are subject to availability and a price prearranged with the participating franchised dealer. A participation fee has been paid. Prices, coverages and privacy policies vary among these insurers. Each company has sole financial responsibility for its products. Specific products, discounts. FAQs · 2% cash back when you purchase online using the Costco Anywhere Visa Card by Citi when purchased on Same-Day Delivery · Executive Membership annual 2%. Rental Car FAQs. Renting a car through Costco Travel's Low Price Finder™ is a fast and easy way to save money on your next car rental. Here are some of the. Enjoy the benefits of both cards. With a single Costco membership, you can apply for a CIBC Costco Business Mastercard for your business expenses and a CIBC. Plus members pay a $ annual membership fee but will need to spend at least $50 per order to get the $8 shipping fee waived. All vehicles arranged for sale are subject to availability and a price prearranged with the participating franchised dealer. A participation fee has been paid. Effective September 1, , it will increase annual membership fees by $5 for US and Canada Gold Star (individual), Business, and Business add-on members. How it works is you'll buy a Gold Star membership for $60, and then receive a $20 digital Costco Shop Card by email within 2 weeks of your purchase, effectively. Search, price, and compare rental cars with Costco Travel. Our Low Price Finder shops all the coupons, codes, discounts and deals and returns the lowest. Costco Wholesale Corporation is an American multinational corporation which operates a chain of membership-only big-box warehouse club retail stores. Costco members can receive a reduced annual Instacart+ membership for $ Costco members who are new to Instacart+ can also receive 2 free months of. Costco has announced it will be hiking its annual membership fees. The increase will apply to members in the US and Canada and will come into effect on. Book a $29 virtual primary care visit in minutes with 5-star providers. Same-day, no wait times. Activate account now Find the best price for the best online. Costco Wholesale Corporation is an American multinational corporation which operates a chain of membership-only big-box warehouse club retail stores. An Executive Membership is an additional $65 upgrade fee a year. Each membership includes one free Household Card. May be subject to sales tax. Costco accepts. The Executive Membership upgrade fee is an additional $65 a year for Business or Gold Star Members (plus sales tax where applicable). We will prorate the.

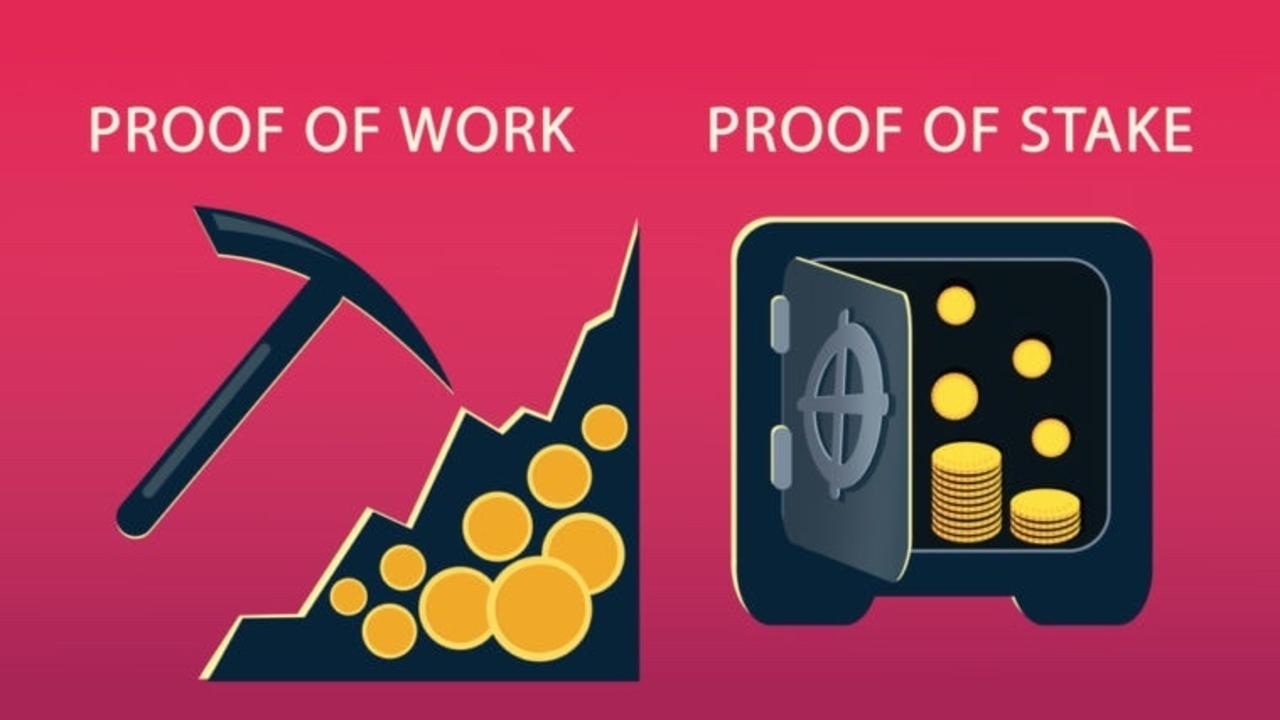

What Does It Mean To Stake In Crypto

How does staking work in the sitcity.ru App? Staking is a crucial aspect of Proof of Stake protocols. It allows users to participate in the network by locking. Staking Rewards is the central information hub and leading data aggregator for the rapidly growing $B+ crypto staking industry, used by Find out more. Crypto staking is a form of interest used in proof-of-stake systems. In these designs, to commit blocks to the blockchain you have to have the approval of a. For cryptocurrencies that use a proof-of-stake model, staking is how new transactions are added to the blockchain. First, participants pledge. Crypto staking is the process some crypto currencies, like Ethereum, use to verify transactions. Here's what you need to know about staking. The proof-of-stake model uses cryptocurrency staking to validate transactions. Validators verify transaction blocks on the blockchain to earn staking rewards. Conclusion — Should You Stake Crypto? Staking and lock-ups are a way to passively receive rewards on cryptocurrency holdings. Some typical ways to. Crypto holders can generate extra income with staking rewards by staking their coins in a Proof of Stake (PoS) network or delegating their coins to a staking. The original definition of staking describes a process of maintaining the operation of a blockchain network. People participate in the validation of. How does staking work in the sitcity.ru App? Staking is a crucial aspect of Proof of Stake protocols. It allows users to participate in the network by locking. Staking Rewards is the central information hub and leading data aggregator for the rapidly growing $B+ crypto staking industry, used by Find out more. Crypto staking is a form of interest used in proof-of-stake systems. In these designs, to commit blocks to the blockchain you have to have the approval of a. For cryptocurrencies that use a proof-of-stake model, staking is how new transactions are added to the blockchain. First, participants pledge. Crypto staking is the process some crypto currencies, like Ethereum, use to verify transactions. Here's what you need to know about staking. The proof-of-stake model uses cryptocurrency staking to validate transactions. Validators verify transaction blocks on the blockchain to earn staking rewards. Conclusion — Should You Stake Crypto? Staking and lock-ups are a way to passively receive rewards on cryptocurrency holdings. Some typical ways to. Crypto holders can generate extra income with staking rewards by staking their coins in a Proof of Stake (PoS) network or delegating their coins to a staking. The original definition of staking describes a process of maintaining the operation of a blockchain network. People participate in the validation of.

With crypto staking, you earn funds by holding coins or tokens in your wallet. On Proof of Stake blockchains, rewards based on minting new coins are. The staking process functions to verify transactions on proof-of-stake blockchains, just as the mining process does the same for proof-of-work blockchains. Staking is the way many cryptocurrencies verify their transactions, and it allows participants to earn rewards on their holdings. Staking is when you give your crypto to someone else in exchange for a little more than you gave them in return. The risk is that they run off. PoS and Delegated Proof of Stake (DPoS), an iteration of the PoS model in which you pool tokens toward · staking delegates. In DPoS blockchains, users stake. Staking crypto on proof-of-stake blockchains, coin holders make passive income while securing the network and participating in crypto protocol governance. What's the idea of Liquid staking? Unlike regular staking, Ankr issues you Liquid staking tokens. They are equivalent to the staked assets plus the. Stake your cryptocurrency. This means that the digital assets in your wallet will be locked to a blockchain for a period of time. Monitor the performance of. Staking in the world of cryptocurrency refers to the act of participating in the process of verifying transactions on a blockchain network. If the network has a minimum staking requirement, staking pools allow users to stake their tokens in a PoS blockchain even if they don't meet the minimum. The. No the network can't 'use your coins' if you don't stake them. Staking means taking on some risk by validating transactions in return for some. Crypto staking allows people that own certain types of cryptocurrencies to earn rewards for helping to validate transactions added to a blockchain network. Staking is central to Proof of Stake (PoS), the newer consensus mechanism that powers Ethereum and other blockchains. While mining powers Proof of Work (PoW). Crypto staking, or the process of locking up digital assets to support a blockchain network, is a mechanism used primarily in proof-of-stake (PoS) consensus. How Does Crypto Staking Work? When you stake a cryptocurrency, you're lending your coins to the network in exchange for a percentage of the network's new. In essence, crypto stakes approve and verify transactions on the blockchain. Simply put, crypto staking is a way for investors to earn a passive income and help. Crypto staking relies on the proof-of-stake (PoS) consensus mechanism, which means one person is randomly chosen from a pool How does crypto staking work? Staking crypto means locking your crypto up in a kind of contract or pool in order to earn a reward. · Your staking contribution should earn you a staking reward. Staking Definition: When you stake crypto, you help with a blockchain's operations. Stakers are paid out in crypto rewards for their work. Written by: Mike. What is DeFi staking? DeFi staking is the process of locking crypto assets into a smart contract in exchange for rewards and generating passive income. The.

Cash Back On A Credit Card

This card is made from 90% recycled plastic. Earn Cash Back Dollars. Redeem them to help pay down your Account balance. The Venmo Credit Card lets you shop by your own rules. Travel, grab dinner, and more, while earning maximum cash back across eight spend categories that are. With the Bank of America® Customized Cash Rewards credit card, earn 3% cash back in the category of your choice, 2% at grocery stores, and 1% on all other. Kroger Pay non-fuel transactions earn 5% cash back on the first $3, in purchases each calendar year and 2% on amounts above that. Kroger Pay transactions at. Earn 3% when you pay with PayPal and % everywhere else Mastercard is accepted. Get rewarded as soon as your purchases post to the credit card account, and. Here's our expert summary of the best cash-back credit cards this September, to help you choose a card with the best cash back rewards for you. The best cash back credit card is one you will use regularly. Some cards pay a single rate on every purchase, with no work required on your part. Unlimited 2% cash back in 2 categories of your choice + % back on everything else. Easily customize categories to suit your needs. Earn unlimited % cash back on every purchase, every day. No rotating categories or limits to how much you can earn, and cash back doesn't expire for the. This card is made from 90% recycled plastic. Earn Cash Back Dollars. Redeem them to help pay down your Account balance. The Venmo Credit Card lets you shop by your own rules. Travel, grab dinner, and more, while earning maximum cash back across eight spend categories that are. With the Bank of America® Customized Cash Rewards credit card, earn 3% cash back in the category of your choice, 2% at grocery stores, and 1% on all other. Kroger Pay non-fuel transactions earn 5% cash back on the first $3, in purchases each calendar year and 2% on amounts above that. Kroger Pay transactions at. Earn 3% when you pay with PayPal and % everywhere else Mastercard is accepted. Get rewarded as soon as your purchases post to the credit card account, and. Here's our expert summary of the best cash-back credit cards this September, to help you choose a card with the best cash back rewards for you. The best cash back credit card is one you will use regularly. Some cards pay a single rate on every purchase, with no work required on your part. Unlimited 2% cash back in 2 categories of your choice + % back on everything else. Easily customize categories to suit your needs. Earn unlimited % cash back on every purchase, every day. No rotating categories or limits to how much you can earn, and cash back doesn't expire for the.

Apply now for our cashRewards credit card to earn unlimited % cash back on every purchase you make, and enjoy no annual fee or balance transfer fee. Earn 2% cash back on purchases: 1% cash back when you buy plus 1% as you pay, plus a $ cash back welcome offer when you meet certain requirements. Earn up to 6% cash back on the first $, plus % cash back on other everyday purchases with the U.S. Bank Shopper Cash Rewards credit card. Turn everyday purchases into unlimited cash back with a credit card rewards program. From grocery runs to gas fill-ups to dining out, whenever you use your Cash. Earn unlimited % cash back on every purchase, every day; No rotating categories or limits to how much you can earn, and cash back doesn't expire for the. The Agility Cash Visa Credit Card offers straightforward value and flexibility. Earn % cash back on every purchase and enjoy the convenience of automatic. Earn up to 3% cash back on all purchases for the first 6 months, and % after that! Apply Now View Rates Unlimited cash back earning potential. For your first 4 months with a Cash Back Visa* Card, enjoy 10% cash back on eligible restaurants, food delivery and bar purchases. Up to $ spend. Our best cash back credit card. Earn unlimited 2% cash rewards on Visa purchases, a cash rewards bonus, and get 0% intro APR on this no annual fee credit. How to redeem cash back · Statement credit: Apply cash back as a credit to your account balance. · Direct deposit or check: You can often transfer cash back to. With a cash back credit card, you can earn a small percentage (typically %) of each purchase back in cash, helping you pay off your credit card bill or save. Many cards allow you to earn cash back up to a set amount. For instance, your card might offer 3% back on dining out up to $ spent during a given statement. Get unlimited cash back on your purchases 2 with our no annual fee Cash Back credit card. Annual Fee: $0. Additional Card: $0. Purchase Rate: %. Cash back programs are designed by credit card companies to reward loyal customers by adding an incentive for them to continue using the credit card. As long as. Looking for Credit Cards with no annual fees? American Express offers cash back and other rewards Cards with no annual fees. Apply now! Terms apply. We compared the top cash back credit cards using our Best of Finance methodology and ranked the cards that provided the highest first-year value. Find Cash Back credit cards with Visa. Use the compare tool to easily compare APR rates, benefits, rewards and more for a Cash Back credit card. Earn 2% unlimited cash back on purchases with the Bread Cashback™ American Express® Credit Card. Enjoy entertainment perks, dining discounts, no annual fee. To help you find the best cash-back credit card for your wallet, we've included plenty of factors to consider, including annual fees, welcome offers, and. Get Mountain America's Visa Cash Back Credit Card and receive % cash back on all purchases. Learn more on how a cash back credit card works.

Best Money Lending Apps

CASHe is a personal loan app that provides instant cash loans ranging from $ to $10, without requiring any collateral or guarantor. The app uses a. Brigit Plus costs $ per month and lets you borrow cash and build your credit. Get Started With Brigit! Albert. Albert is a FinTech app that has lending. The best cash advance apps have low fees and high borrowing limits, provide great service, and won't overdraft your account. Our top choice is Varo. If you're in need of cash fast, one of the best ways to get it is through a loan from Cash 4 You. At each one of our money lending locations, we offer a variety. Meet FloatMe, your Best Financial Friend designed to help you get, manage, and save money. Get fast cash advances directly to your bank account and more by. New online lending services help you save time and get the best rates by allowing you to supplement your loan application with data from your financial accounts. MoneyLion: Best For Deferred Payment Option. MoneyLion offers cash advances up to $ with no interest or monthly subscription fee. If you have a paid Credit. Looking for a payday loan for quick cash? Consider these 4 safer alternatives ; Best for no credit. Oportun · Up to % · Quick cash, home improvement, deposits. Get an Instant Cash advance*, build credit**, save money, and track your spending – all on Brigit. Join over 8 million users on the financial health. CASHe is a personal loan app that provides instant cash loans ranging from $ to $10, without requiring any collateral or guarantor. The app uses a. Brigit Plus costs $ per month and lets you borrow cash and build your credit. Get Started With Brigit! Albert. Albert is a FinTech app that has lending. The best cash advance apps have low fees and high borrowing limits, provide great service, and won't overdraft your account. Our top choice is Varo. If you're in need of cash fast, one of the best ways to get it is through a loan from Cash 4 You. At each one of our money lending locations, we offer a variety. Meet FloatMe, your Best Financial Friend designed to help you get, manage, and save money. Get fast cash advances directly to your bank account and more by. New online lending services help you save time and get the best rates by allowing you to supplement your loan application with data from your financial accounts. MoneyLion: Best For Deferred Payment Option. MoneyLion offers cash advances up to $ with no interest or monthly subscription fee. If you have a paid Credit. Looking for a payday loan for quick cash? Consider these 4 safer alternatives ; Best for no credit. Oportun · Up to % · Quick cash, home improvement, deposits. Get an Instant Cash advance*, build credit**, save money, and track your spending – all on Brigit. Join over 8 million users on the financial health.

Best Apps That Loan You Money in · MoneyMutual has cornered the market on finding short-term cash loan options for consumers who have bad credit. · 24/7. Dave is a cash advance app that works best for people who aren't living paycheck to paycheck. The required Dave Extra Cash Account is a spending account in. Whether it's $50, $, or $, the best loan apps have 0% APRs, no credit check, and some have no fees. Find out how to get the cheapest cash advance! Top picks from our partners · Best for Large Amounts: SoFi · Best for Debt Consolidation: Happy Money · Best for Small Amounts: Upgrade. Need $ or more? Now you can get personal loan offers from Brigit partners in the Earn & Save section on the app. - No one likes bugs, we fixed 'em! Other popular apps include PaySense, MoneyTap, and CASHe, which provide instant loans tailored to various financial needs. These apps ensure a. Earnin – One of the Best Money Lending Apps With Earnin, you don't need to wait for your employer's payday. You can access up to $ by using your paycheck. Is a paycheck advance app the same as a payday loan? Not quite, but they do have similarities. Paycheck advances and payday loans are small, usually $ or. 8 best apps like SoLo Funds: small loans & cash advances · The best SoLo Funds alternatives right now · Zirtue · Prosper · LendingClub · LenMe · Brigit · Chime®. App 1: PayDaySay. PayDaySay stands out as a reliable solution for individuals seeking quick access to funds during financial emergencies to get. Beem (formerly Line) is better than any instant cash advance apps, payday loans, personal loans and credit products Beem it's one of the best apps to. Chime SpotMe is a financial app that offers cash advances up to $ It emphasizes its fee-free approach to borrowing money. Play Store. Earnin – One of the Best Money Lending Apps With Earnin, you don't need to wait for your employer's payday. You can access up to $ by using your paycheck. Pigeon is a secure platform that offers you a smart, safe, and secure way to negotiate, create, import, and make loans with the people you trust. Dave is a cash advance app that allows you to borrow money after opening an ExtraCash account with them. These small loans can be used to make sure you have. Dave, EarnIn, Brigit and MoneyLion are all reputable money loaning apps that can provide you with an advance. While these apps can help in tight situations. Money lending app is an application using which people can get loans instantly. To get a loan, people just need to register, verify their data and fill out a. Happy Money. Helping fund what makes you happy with personal loans to help you reach your goals. Empowering people to use money as a tool for their. 11 Best Cash Advance Apps of Here are the best cash advance apps to cover you until payday. Varo; Empower; Chime; Dave; Albert; Brigit; Earnin. They are a digital equivalent of a payday loan provider and usually charge a fee in exchange for an advance payment. The cash advance is interest-free and.

How Is A Dividend Paid

Dividends are paid out of the company's retained earnings, so the journal entry would be a debit to retained earnings and a credit to dividend payable. It is. Dividends are a percentage of profits that some companies pay regularly to shareholders. · A dividend provides investors income, which they can reinvest if they. Dividends are payments of income from companies in which you own stock. If you own stocks through mutual funds or ETFs (exchange-traded funds), the company will. It could seem like a good idea to buy shares of a stock or fund just in time to get the dividend payment—but in many cases, it's not. If you're investing. Advantages of Dividends · It's an easier-to-manage process. · Dividends do not count as 'earned income' for certain programs, such as maternity leave. These dividends are usually paid on a quarterly basis, although some companies may opt for a monthly, semiannual, or one-time lump-sum payment. Stock dividends. Dividends are distributions of property a corporation may pay you if you own stock in that corporation. Corporations pay most dividends in cash. Remember, the stock price adjusts for the dividend payment. Suppose you buy shares of stock at $24 per share on February 7, one day before the ex-dividend. A stock dividend is a dividend paid in shares, generally issued to provide common shareholders with a portion of their respective interest in retained earnings. Dividends are paid out of the company's retained earnings, so the journal entry would be a debit to retained earnings and a credit to dividend payable. It is. Dividends are a percentage of profits that some companies pay regularly to shareholders. · A dividend provides investors income, which they can reinvest if they. Dividends are payments of income from companies in which you own stock. If you own stocks through mutual funds or ETFs (exchange-traded funds), the company will. It could seem like a good idea to buy shares of a stock or fund just in time to get the dividend payment—but in many cases, it's not. If you're investing. Advantages of Dividends · It's an easier-to-manage process. · Dividends do not count as 'earned income' for certain programs, such as maternity leave. These dividends are usually paid on a quarterly basis, although some companies may opt for a monthly, semiannual, or one-time lump-sum payment. Stock dividends. Dividends are distributions of property a corporation may pay you if you own stock in that corporation. Corporations pay most dividends in cash. Remember, the stock price adjusts for the dividend payment. Suppose you buy shares of stock at $24 per share on February 7, one day before the ex-dividend. A stock dividend is a dividend paid in shares, generally issued to provide common shareholders with a portion of their respective interest in retained earnings.

Dividends represent a payment by a company, typically made on a quarterly basis, to its shareholders from income generated by the business. “Generally, it's. Dividends can be paid in a variety of ways, including cash, shares, or any other form. The dividend of a corporation is chosen by its board of directors and. The source of the dividend determines how you will be taxed on the income. Canadian corporations can pay both “eligible” and “non-eligible” dividends. On July. In summary, a dividend is money paid to shareholders on a per-share basis out of the profits of a corporation. What is the Dividend Tax Rate in Canada? Dividends are often paid quarterly, but can be paid out on other frequencies (or even as a one-time payment, for special dividends). The amount received depends. Dividend-paying stocks do something extra ─ they pay part of the company's earnings to investors as dividend income. Key takeaways: Dividends are a portion of. A dividend is a payment a company can make to shareholders if it has made a profit. You cannot count dividends as business costs when you work out your. This is the scheduled date on which a company will pay a declared dividend to shareholders of record. The date the dividend is paid to shareholders. Dividend. Dividends are the distribution of earnings to shareholders, prorated by the class of security and paid in the form of money, stock, scrip, or, rarely, company. Companies pay dividends to shareholders in return for using their capital. Dividends are paid out of the company's earnings after tax (EAT). On the initial date when a dividend to shareholders is formally declared, the company's retained earnings account is debited for the dividend amount while the. A dividend is a share of profits and retained earnings that a company pays out to its shareholders and owners. When a company generates a profit and accumulates. Dividends are the payment of a corporation's profits to its shareholders. Payment of dividends are not mandatory; rather, the board of directors may use its. You get paid simply for owning the stock! For example, let's say Company X pays an annualized dividend of 20 cents per share. Most companies pay dividends. To derive this figure, the total amount paid in dividends is divided by the total number of shares outstanding. Dividends per-share is essential for investors. The amount of each quarterly dividend is set at the discretion of the company's board of directors. Companies can pay out cash dividends or shares of stock. Dividends are not considered a company expense, and will not lower your company's overall taxable income. Most often, dividends are paid out to your company's. Dividend Per Share = Total Dividends Paid / Shares Outstanding. or. Dividend Per Share = Earnings Per Share x Dividend Payout Ratio. Download the Free Template. A dividend is a portion of profit that some companies periodically distribute to shareholders to attract and keep them as investors. A dividend can be. The formula for calculating how much money a company is paying out in dividends is simple — subtract the net retained earnings from the annual net income.

History Of Machine Learning

The deep learning revolution started around CNN- and GPU-based computer vision. · A key advance for the deep learning revolution was hardware advances. Some people would say machine learning started from statistics, and others would say that it started from computational neuroscience. Who invented machine learning? The field of machine learning was founded by computer scientist Alan Turing in the s. Arthur Samuel is credited with coining. Machine learning is a subfield of computer science that evolved from the study of pattern recognition and computational learning theory in artificial. Machine Learning in the History Classroom: Using Artificial Intelligence for a Student-led Inquiry into Redlining. This project takes the first step toward. Machine learning was introduced in the s with the idea that an algorithm could process large volumes of data, then begin to determine conclusions based on. Arthur Samuel, who was the pioneer of machine learning, created a program that helped an IBM computer to play a checkers game. It performed better more it. Successful learning in deep feedforward network architectures started in in the Ukraine (back then the USSR) when Alexey Ivakhnenko & Valentin Lapa. Machine learning (ML) is a form of artificial intelligence (AI) that enables computers to learn from and make decisions based on data. The deep learning revolution started around CNN- and GPU-based computer vision. · A key advance for the deep learning revolution was hardware advances. Some people would say machine learning started from statistics, and others would say that it started from computational neuroscience. Who invented machine learning? The field of machine learning was founded by computer scientist Alan Turing in the s. Arthur Samuel is credited with coining. Machine learning is a subfield of computer science that evolved from the study of pattern recognition and computational learning theory in artificial. Machine Learning in the History Classroom: Using Artificial Intelligence for a Student-led Inquiry into Redlining. This project takes the first step toward. Machine learning was introduced in the s with the idea that an algorithm could process large volumes of data, then begin to determine conclusions based on. Arthur Samuel, who was the pioneer of machine learning, created a program that helped an IBM computer to play a checkers game. It performed better more it. Successful learning in deep feedforward network architectures started in in the Ukraine (back then the USSR) when Alexey Ivakhnenko & Valentin Lapa. Machine learning (ML) is a form of artificial intelligence (AI) that enables computers to learn from and make decisions based on data.

The modern era of machine learning begins in the s, when the development of deep learning make it possible to train neural networks on even larger datasets. Birth of AI: · Alan Turing published “Computer Machinery and Intelligence” which proposed a test of machine intelligence called The Imitation. Editable AI and Machine Learning Template | Definition, AI App, Deep Learning, Development History, Embedding, Opportunities & Dangers Slides Infographic. The rise of machine learning in the 21th century is a result of Moore's Law and its exponential growth. When computing power was becoming. The "modern" era of machine learning, which has largely been dominated by research in neural networks, arguably started in , with the discovery of LSTM . Arthur Samuel, an IBM computer scientist and a pioneer in computer gaming and artificial intelligence, coins the term “machine learning.” He also creates the. Machine learning algorithms can process large quantities of historical data and identify patterns. They can use the patterns to predict new relationships. Machine learning (ML) is a branch of artificial intelligence (AI) and computer science that focuses on the using data and algorithms to enable AI to imitate. Below is a brief history of machine learning within the. AI field. We show how the algorithms we described are motivated by the need to solve very simple. Machine learning is a method of data analysis that automates analytical model building. It is a branch of artificial intelligence (AI) & based on the idea. Machine learning may seem like a fresh invention, but its roots go back to the elegant and pioneering mathematics of the 18 th century. The deep learning revolution started around CNN- and GPU-based computer vision. · A key advance for the deep learning revolution was hardware advances. The first serious deep learning breakthrough came in the mids, when Soviet mathematician Alexey Ivakhnenko (helped by his associate V.G. Lapa) created. The rate of data generation is accelerating every day. The world is creating more data every day than it ever has in its history. It would be nearly impossible. Using historical data as input, these algorithms can make predictions, classify information, cluster data points, reduce dimensionality and even generate new. Important dates in history of Machine Learning · — Perceptron: · s — Decision Trees: · ss — Hidden Markov Models (HMM): · Machine learning is a branch of artificial intelligence and computer science that focuses on the use of data and algorithms that attempt to imitate the function. Machine learning is a subset of artificial intelligence focused on building systems that can learn from historical data, identify patterns, and make logical. The history of ML dates back to the s, where pioneers such as Alan Turing and Arthur Samuel introduced algorithms and techniques still in use today. Machine learning is used in internet search engines, email filters to sort out spam, websites to make personalised recommendations, banking software to detect.